UNCOVER TOMORROW'S TALENTS TODAY

NewAlpha Asset Management is an investment manager specializing in the design, analysis and implementation of innovative and customized investment solutions for leading institutional investors.

Recognised worldwide for its ability to source, select and support independent investment managers and innovative technology-driven companies, New Alpha Asset Management offers its expertise in three business lines: Multi-Management, Investment Advisory and Private Equity / Venture Capital.

As of December 31, 2023, NewAlpha manages and advises $3.3 billion on behalf of insurance companies, pension and retirement institutions, corporates and family offices.

As a global investor, NewAlpha is a player committed to sustainable investment.

News

Cozero raises €6.5 million Series A to pioneer a new generation of Climate ERP solutions

Berlin, April 16, 2024 - Cozero, the ClimateTech software company winner of the German Sustainability Award, announced it has... more

17 April 2024

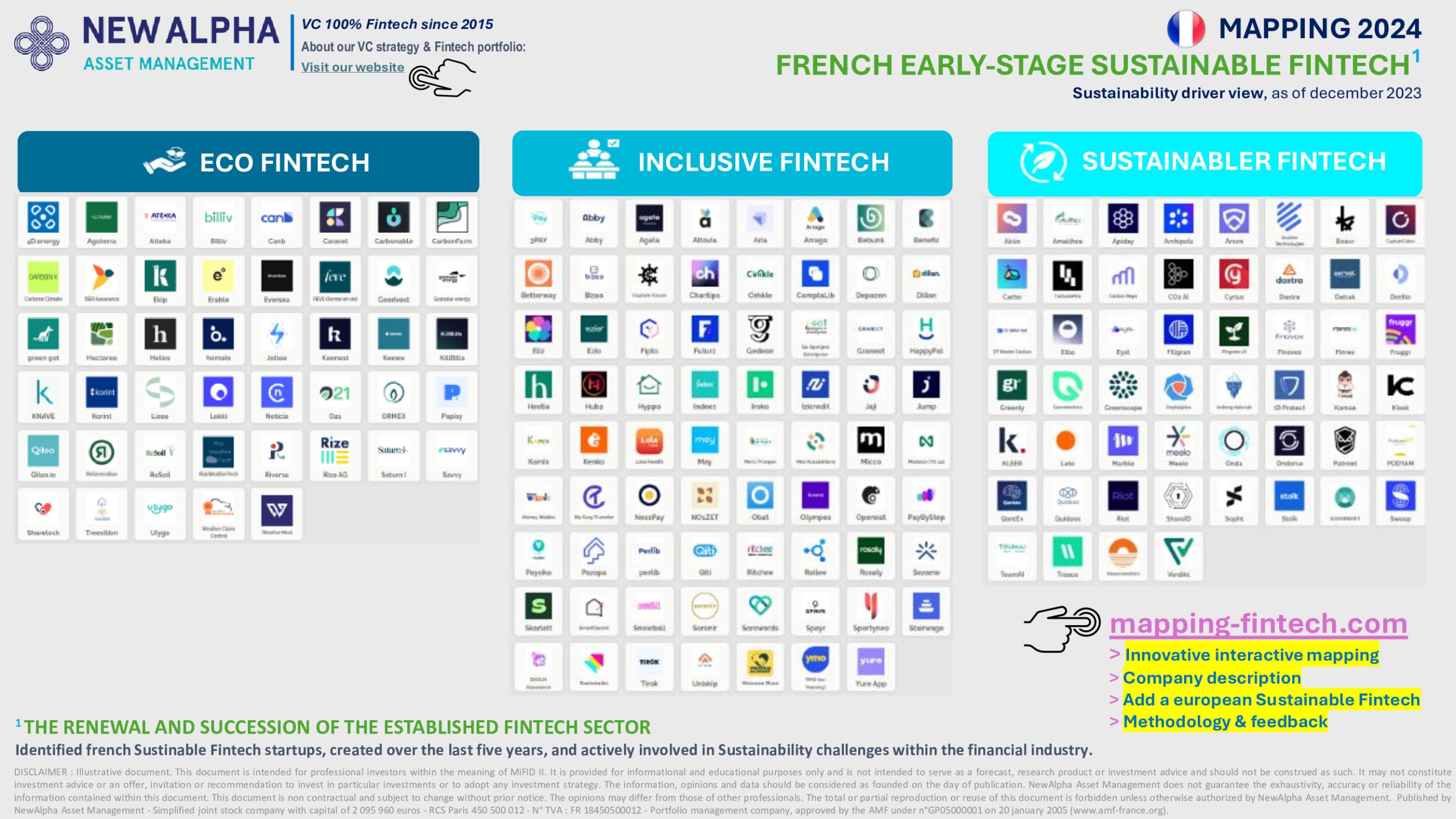

2024 Mapping of French Early Stage Sustainable Fintechs

FRENCH EARLY STAGE SUSTAINABLE FINTECHS : 2024 MAPPING Paris, March 6, 2024 NEWALPHA ASSET MANAGEMENT ADDRESSES THE 7th EDITION OF... more

7 March 2024

LIZY, pioneer of digital leasing, celebrates its anniversary with a major fund-raising round

Paris - February 29, 2024 In just five years, Belgian start-up LIZY has revolutionized the vehicle leasing sector,... more

29 February 2024

Obat raises €12 million to consolidate its position as the benchmark software for the construction industry

Paris, November 22, 2023 - Obat, a SaaS solution that supports the growth of building professionals, has closed a €12... more

23 November 2023