In order to offer its clients investments with little or no correlation to traditional markets, New Alpha composes robust portfolios in many market configurations with absolute return funds.

New Alpha’s expertise in absolute return strategies

Thanks to its extensive experience and historical presence in this sector, New Alpha offers its clients privileged access to differentiated and high-quality managers.

The so-called “Absolute Return” strategies aim at a regular and positive performance over the long term while limiting the volatility of investments.

Privileged access to the most promising funds

However, accessing absolute return funds can be a challenge for investors due to the complexity of the strategies implemented and the limited capacity offered by the most talented managers.

Thanks to its resources and experience, New Alpha enables its clients to approach this very rich opportunity sector with the objective of building portfolios that are decorrelated from market risks.

New Alpha’s offer

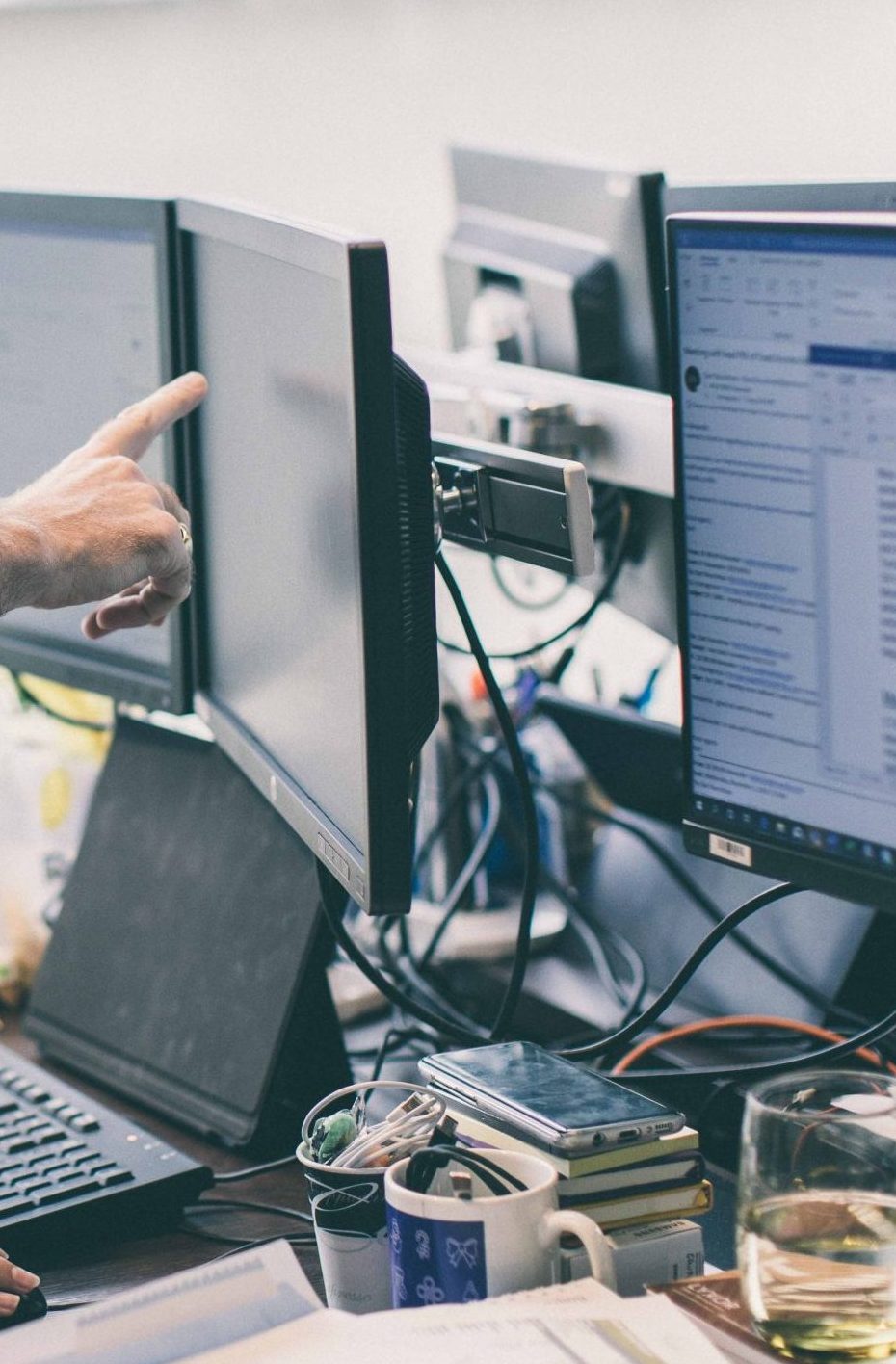

New Alpha is skilled in all alternative investment techniques thanks to the accumulated experience and the diversity of its analysts’ profiles. Quantitative engineers also support the portfolio managers and analysis teams.

New Alpha implements several investment approaches in the field of Absolute Return strategies:

- Diversified multi-manager portfolios of absolute return funds

- Concentrated portfolios of funds with an incubation or acceleration objective for selected management companies

According to the terms of its investment mandates, New Alpha seeks to obtain preferential investment conditions for its clients.

New Alpha's expertise in Absolute Return Multi-Management is characterized by:

New Alpha offers this expertise in different forms:

Extra-financial criteria are considered at two levels: selection of investment management companies and selection of funds.