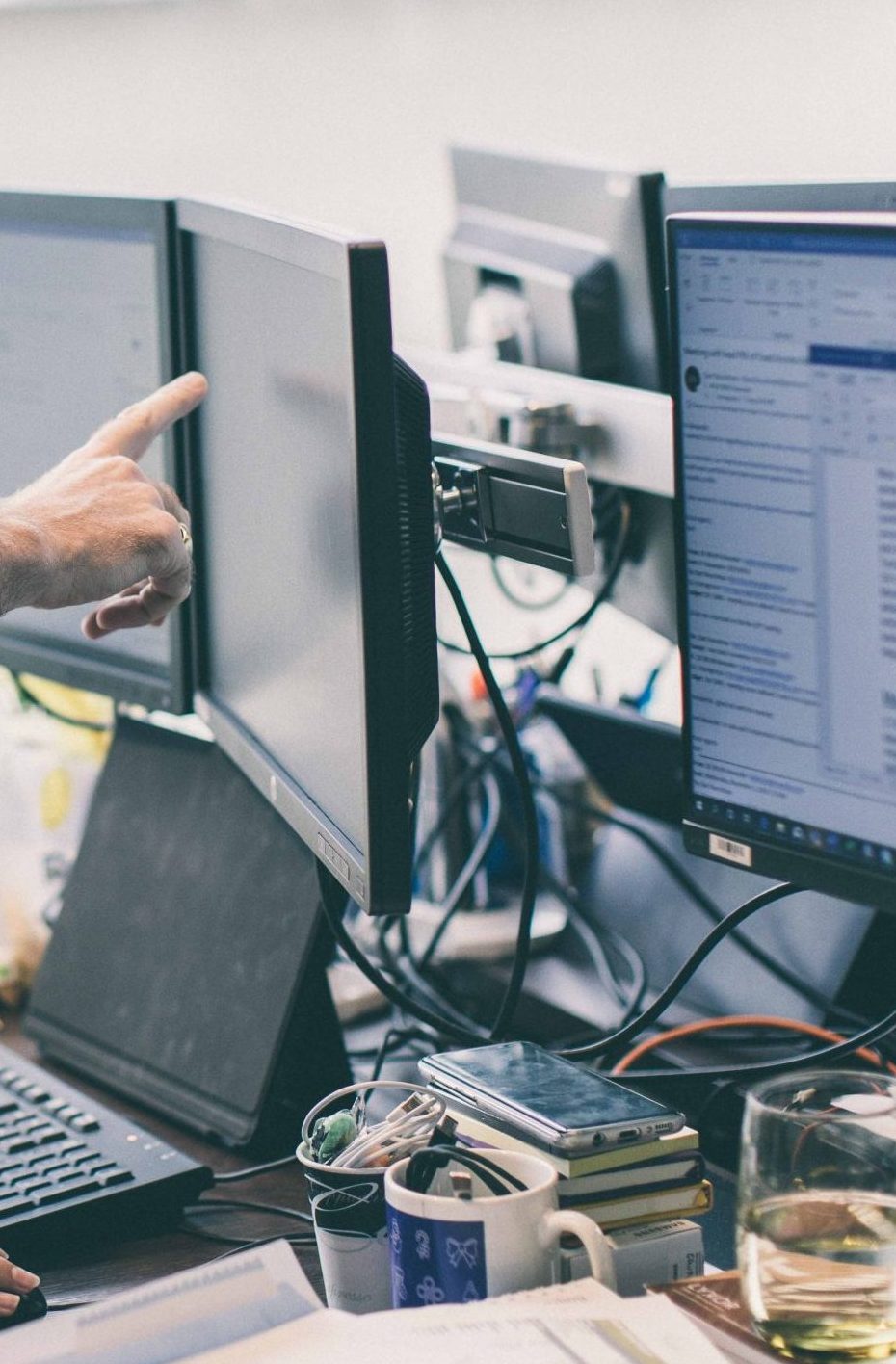

Thanks to its long experience and constant presence in this sector, New Alpha offers its clients privileged access to unique and high quality listed equity funds.

Benefits of multi-manager investing

A multi-manager portfolio offers investors several benefits, including:

- Diversification of risks and sources of return;

- The ability to access specialized funds, which are often not easily accessible;

- The ability to build and manage portfolios that best meet investment objectives and constraints, and ESG criteria.

New Alpha’s offer

New Alpha’s offer is divided into two categories:

- Diversified multi-manager equity portfolios. This includes thematic and generalist funds of funds, and management mandates. New Alpha offers funds dedicated to professional investors.

- Concentrated portfolios of funds with the objective of seeding or accelerating promising investment managers. In this context, New Alpha enables managers to reach a milestone in terms of assets under management. In return for the commitment of New Alpha’s clients to remain invested for a predefined period, the managers concerned commit to share part of their revenues, that results into an additional source of return for investors.

Support to and mentoring selected managers

With its knowledge of institutional investors, NewAlpha can support selected investment managers in their growth and adoption of best investment practices.

Preferential investment terms

According to the parameters of its investment mandates, New Alpha seeks to obtain preferential investment conditions for its clients, notably on management fees.

New Alpha's expertise in Public Equity Multi-Management is characterized by:

This expertise is offered to investors in different forms:

Pioneer of ‘responsible multi-management

New Alpha is convinced that compliance with ESG criteria is not a constraint, but a real opportunity to reduce risks and deliver a superior long-term performance.

Investors now want to have a positive impact or, at least, reduce the negative externalities that their investments could have on society.

Aware of this growing demand, New Alpha anticipates its clients’ expectations in terms of responsible investment, particularly in the field of multi-management.

A cross-assessment between managers and funds

ESG criteria are systematically assessed at two levels: investment managers and funds.

New Alpha considers that the funds proposed by a manager reflect his convictions, including those related to ESG.

High-performance measurement tools

To quantify a manager’s extra-financial performance, New Alpha has developed an original rating method coupled with a strict exclusion policy on each of the E, S and G aspects, in line with its clients’ requirements.